Consequences of Federal $15 Minimum Wage Outlined in New Book

Economists Estimate Up to 2 Million Jobs Would Be Lost

-

Publication Date: January 2019

-

Topics: Living Wage

WASHINGTON, D.C.– Today, the Employment Policies Institute (EPI) released, “Fighting $15? An Evaluation of the Evidence and a Case for Caution,” a nine-chapter book that examines the many consequences regarding a federally mandated $15 minimum wage. The book is accompanied by a policy briefthat highlights the book’s key takeaways. The book is complemented by EPI’s website FacesOf15.com, which tracks specific business closures following minimum wage increases.

Download a copy of the full book here.

Download a copy of the policy brief here.

The book’s authors include labor economists, business leaders, and policy analysts; each with unique experience in the minimum wage debate. The book’s chapters cover all aspects of the debate over a $15 minimum wage, including the policy’s impact on the job market, on taxpayers, and on poverty rates. It also explores evidence-based alternatives to raising the minimum wage that are more effective at reducing poverty.

The book’s key highlights include the following:

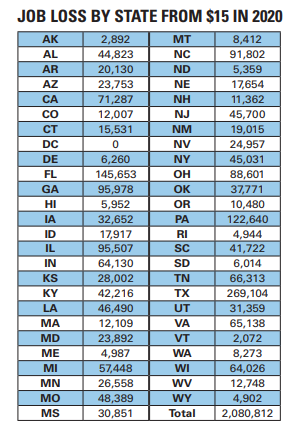

- $15 would have dramatic negative employment impacts: Following a methodology developed by the non-partisan Congressional Budget Office, a $15 federal minimum wage would cost roughly two million jobs if implemented in 2020; even a slower phase-in for the policy, by 2026, would cost the country more than 850,000 jobs;

- There’s no historical precedent for $15: A $15 minimum wage would cover 44 percent of the hourly workforce, compared to roughly three percent covered by the current federal minimum wage. The average historical federal minimum wage is $7.40 an hour, or roughly 15 cents higher than the current figure;

- A $15 minimum wage is not well-targeted to individuals in poverty: Nearly half (48.4 percent) of those who would be affected by a $15 minimum wage live in households with annual incomes that are three times above the federal poverty rate; the average family income of these employees is $56,982;

- Employees who earn the minimum wage are disproportionately young and more likely to be employed at smaller businesses:Among hourly employees who earn the federal minimum wage, 36 percent are aged 16-21, compared to just 11 percent of all hourly employees. Nationwide, 2.6 percent of employees at very small businesses (fewer than 10 employees) earned the minimum wage, compared to 1.5 per at businesses with 100 or more employees;

- There are better alternatives to raising the minimum wage: The book describes how the Earned Income Tax Credit has a proven track record of reducing poverty and has already created a more than $10 minimum wage for many single parents. Also discussed is research showing that the majority of minimum wage employees earn a raise within one year on the job.

The policy brief also includes a chart that breaks down by state the projected job loss of a federal $15 minimum wage in 2020 using Congressional Budget Office methodology. View the chart here or below.