Historical Perspective

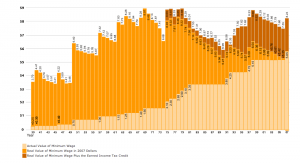

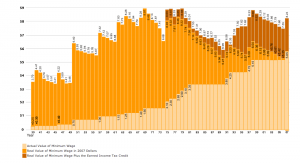

The History of the Nominal and Real Value of the Minimum Wage Including the Real Value of the Earned Income Tax Credit

Proponents of a federally mandated increase in the minimum wage have stated that the wage floor is no longer able to support working families with children, and should be returned to the 1968 value, when the minimum wage was at its peak in real value. Proponents of wage floor increases claim that the real value of the minimum wage has steadily fallen over the past few decades due to inflation, and has thus hurt families with children.

The data shown below shows that while the nominal value of the minimum wage has not changed since 1996, the real value of the minimum wage in 2002 dollars (adjusted for inflation), plus the real value of the Earned Income Tax Credit for a full-time minimum wage employee with two children is only 7.6% lower today. Increases in the EITC have retained the value of the minimum wage for employed families, thus maintaining much of their overall spending power over time. Using the EITC allows our government to effectively target assistance to the small proportion of the workforce raising families on low incomes, instead of a blunt and unfunded minimum wage mandate which would inefficiently distribute assistance to individuals without children or in dual-earner situations.

Comparison of the Real and Actual Value of the Minimum Wage Plus the Earned Income Tax Credit

Further Reading

September 2010: Still Searching: Long Term Teen Unemployment as of August 2010 (pdf)

May 2010: Out of School, Out of Luck: Employment Prospects for High School Dropouts (pdf)

April 2010: Still Searching: Long Term Teen Unemployment As of April 2010 (pdf)

March 2010: Still Searching: Duration of Teen Unemployment Heading into Summer 2010 (pdf)