The average family income of United States employees who would ‘benefit’ from the new $7.25 minimum wage is over $47,023. The 70 cent bump that goes into effect on July 24, 2009, is the third step in a 41% increase in the starting wage.

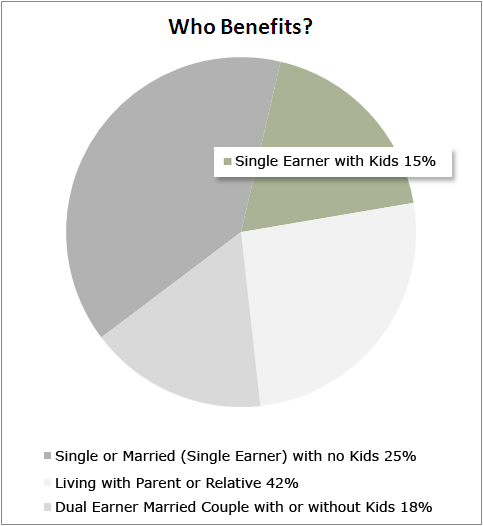

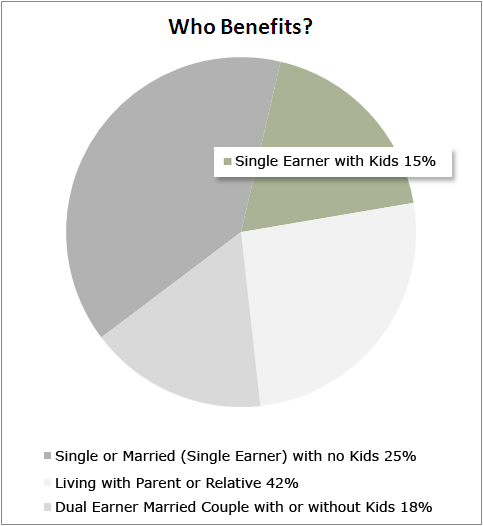

According to U.S. Census Bureau data, fully 84% of employees in United States whose wages would be increased by the proposed minimum wage hike either live with their parents or another relative, live alone, or have a working spouse. Just 16% are sole earners in families with children, and each of these sole earners has access to supplemental income through the Earned Income Tax Credit.

Today’s minimum wage is being increased because of legislation passed in 2007, when unemployment was still under 5 percent and the economy was stronger. This new wage will make it difficult for the most vulnerable employees in the workplace to compete with higher skilled applicants.